Cryptorank

SEC Approves Spot Ethereum ETFs, Opening New Investment Opportunities

Regulation Amid Market Concerns

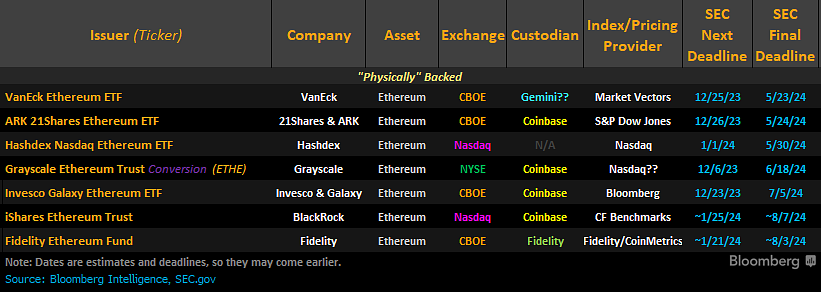

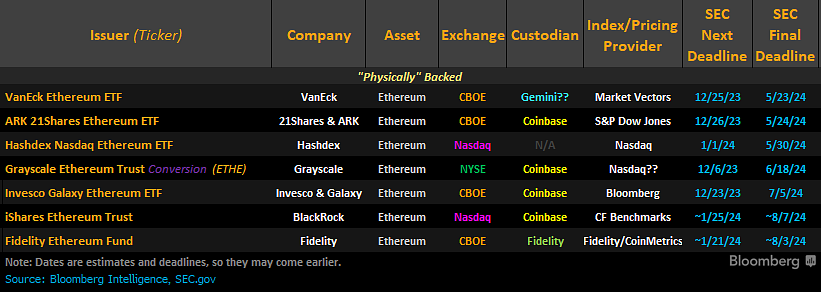

The Securities and Exchange Commission (SEC) has approved applications from Nasdaq, CBOE, and NYSE to list exchange-traded funds (ETFs) tied to the price of Ethereum (ETH). The agency had previously expressed concerns about the susceptibility of spot Ethereum ETFs to market manipulation and fraud, but Chairman Gary Gensler recently acknowledged the growth and maturation of the digital asset ecosystem.

SEC's Cautious Approach

The SEC's approval of spot Bitcoin ETFs in 2021 was a significant milestone for the cryptocurrency industry. However, the agency has yet to approve any spot Ethereum ETFs. This delay is due to concerns about the underlying market for ETH, which has been plagued by volatility and allegations of market manipulation.

Industry Advocates Call for Spot Ethereum ETFs

In March 2024, several members of the House of Representatives urged the SEC to approve spot Ethereum ETFs, citing the growing interest in Ethereum and the potential benefits for investors. They argued that these ETFs would provide a more efficient and accessible way for investors to participate in the Ethereum ecosystem.

Grayscale's Dominance and High Fees

Grayscale, a leading cryptocurrency investment firm, currently controls over $10 billion worth of ETH through its Ethereum Trust (ETHE). However, Grayscale's management fees are considered excessive by many investors. The approval of spot Ethereum ETFs would create competition for Grayscale and potentially lower fees for investors.

Implications for the Ethereum Market

The SEC's approval of spot Ethereum ETFs is expected to have a positive impact on the Ethereum market. These ETFs will provide institutional investors with a new way to gain exposure to Ethereum, which could increase liquidity and stability in the market. It is also likely to attract more retail investors to the Ethereum ecosystem, further driving its growth and adoption.

Coingape

Comments